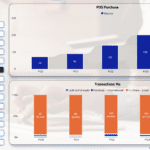

Swipe Culture Takes Hold: POS Transactions Triple Since 2020

May 7, 2025

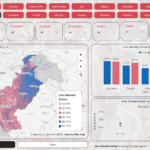

Where Are Pakistan’s Out-of-School Children?

May 19, 2025In Pakistan, ATMs are everywhere, but they are still used mostly for one thing: getting cash. According to data for the 2023–24 financial year, 90 percent of the total value and 96 percent of all ATM transactions were for cash withdrawals. This means that almost every time someone uses an ATM, they take out cash rather than using other services like depositing checks or paying bills.

Limited ATM Functions

Since 2020, ATM use for cash withdrawals has not changed much. Other functions—such as cheque deposit, utility bill payments, or mobile top-ups—have not grown in popularity. Simply put, people still see ATMs as cash dispensers only. This trend shows that digital banking in Pakistan has room for growth, especially if we want more people to use a wider range of services.

Why Digital Financial Inclusion Matters

Digital financial inclusion means giving everyone—urban and rural—a chance to use modern banking tools. When people can pay their electricity bills, transfer money, or deposit cheques at an ATM, they save time and avoid long bank queues. Unfortunately, the data from our ATM transactions dashboard suggests that many Pakistanis are not yet taking full advantage of these services.

Introducing the ATM Transactions Dashboard

At Gallup Pakistan Digital Analytics, we built a dashboard to track these trends in Pakistan’s digital financial landscape. Our dashboard uses data from the central bank and other sources to show where ATMs are used most, which services are popular, and how usage is changing over time. This tool can help policy makers, bank managers, and technology providers see the gaps in digital banking services and plan better solutions.

Steps Toward a More Inclusive System

To drive digital inclusion, banks and regulators can take several steps. First, they can upgrade ATM networks to support more services like bill payments and cheque deposits. Second, they can run public campaigns to teach people how to use these features. Third, they can offer small incentives—such as lower fees—for using non-cash ATM functions. These efforts can encourage users to explore the full potential of ATMs and reduce reliance on cash.

Conclusion

While cash remains king at ATMs in Pakistan, there is a clear opportunity to expand digital banking services. By improving ATM features and educating the public, we can move closer to a cashless economy and ensure that more people benefit from digital financial inclusion.

👉 Explore the full dashboard here:

https://galluppakistandigitalanalytics.com/state-bank-of-pakistan-payment-systems-dashboard/