Zooming Forward: Pakistan’s Motorcycle Revolution

April 18, 2025

ATM Usage in Pakistan: Cash Rules and Digital Gaps

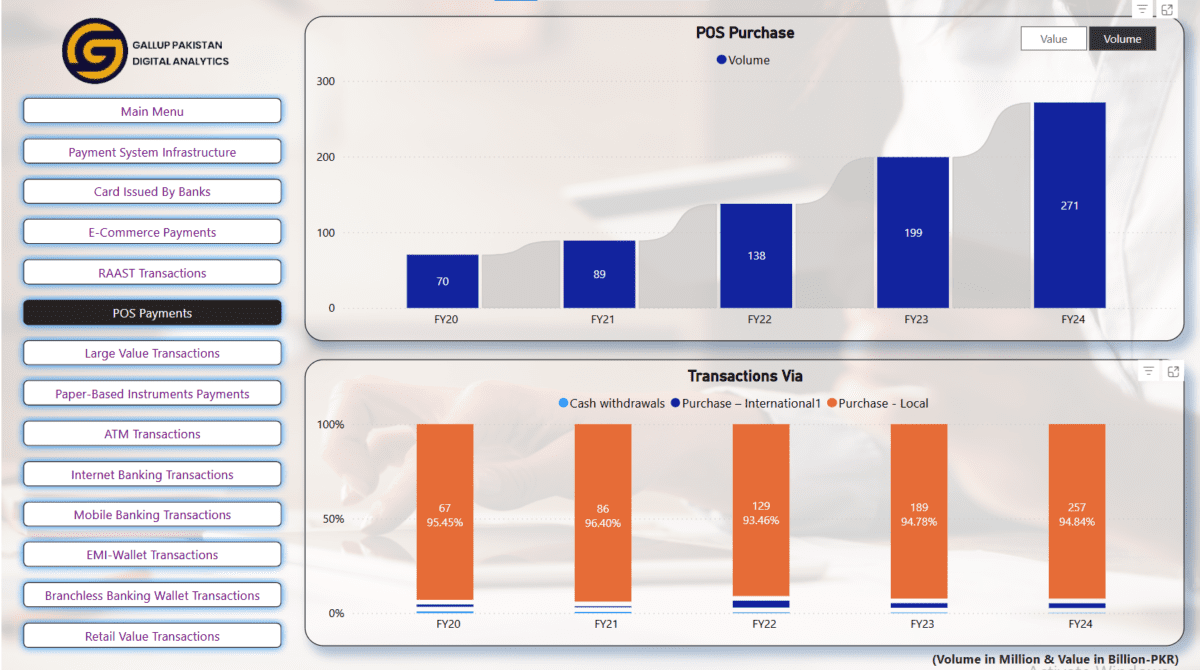

May 14, 2025Pakistan is changing the way it pays for goods and services. Not long ago, point of sale (POS) machines were hidden away, and swiping a card felt like a special event. Connection problems were common, and most people still paid with cash. Today, the story is different. From 2020 to 2024, POS transactions in Pakistan have soared by nearly 300 percent. This rise shows that digital payments in Pakistan are becoming normal for businesses and customers alike.

The value of POS transactions has also climbed by around 300 percent, which means the average amount spent per transaction has stayed about the same. In simple terms, people are using cards and digital wallets more often, but they are not spending much more each time they swipe. This steady average transaction value suggests that digital payments are not just for big purchases; they are used for everyday items like groceries, medicines, and school fees.

At Gallup Pakistan Digital Analytics, we have created a Digital Payment Infrastructure Dashboard to track these changes. Our dashboard uses data from the State Bank of Pakistan and other sources to show how POS usage trends have grown, how many merchants accept cards, and which regions are leading the way in digital payment adoption. This dashboard is a useful tool for policy makers, business owners, and researchers who want to understand Pakistan’s digital payment ecosystem.

In urban centers like Karachi, Lahore, and Islamabad, the uptake of POS machines has been rapid. Shopkeepers, from large supermarkets to small roadside vendors, now display a POS machine as a sign of professionalism and trust. In smaller towns and rural areas, the growth is slower but steady. Mobile POS units and simpler card readers are helping to bring financial inclusion to places that once relied solely on cash.

The shift to digital payments benefits everyone. Customers enjoy faster checkouts and can avoid carrying large amounts of cash. Businesses reduce the risk of theft and improve their record-keeping. The government gains better tax data and can design more effective economic policies.

As Pakistan’s economy grows, the digital payment infrastructure must keep pace. Expanding internet access, ensuring reliable electricity, and offering training to merchants are key steps. With our dashboard, stakeholders can pinpoint where support is needed most and measure progress over time.

The future of digital payments in Pakistan looks bright. As POS transactions continue to rise, a cashless culture will help Pakistan become more efficient, secure, and connected.

Explore the full dashboard here:

https://galluppakistandigitalanalytics.com/state-bank-of-pakistan-payment-systems-dashboard/