Pakistan vs India: GDP tells one story, household assets tell another

January 19, 2026

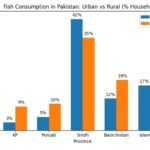

Fish in Pakistan: Rarely eaten except in Sindh

January 21, 2026Pakistan’s total motorcycle market is around 26–30 million units, with annual sales in the 1.3–1.5 million range in recent years.

Electric two‑wheelers were effectively negligible before supportive policies in 2023, but by the first nine months of 2025 EV 2‑wheeler sales reached 56,647 units and accounted for about 4.6% of the total two‑wheeler industry volume.

This shift, while still small in absolute terms, is structurally important. Pakistan’s motorcycle market is one of the largest in the world relative to income levels, driven by necessity rather than choice. Motorcycles are not lifestyle products; they are the backbone of daily mobility for workers, students, delivery riders, and small businesses. Any change in this segment therefore signals deeper economic and policy forces at work.

The rapid emergence of electric two-wheelers is best understood as a response to operating costs rather than environmental awareness. Rising petrol prices, fuel shortages, and volatile exchange rates have steadily increased the lifetime cost of owning an internal combustion engine (ICE) motorcycle. In contrast, electric two-wheelers offer dramatically lower per-kilometre costs, particularly for high-usage riders such as couriers and ride-hailing drivers. For many households, the decision is increasingly framed as a budgeting calculation, not a technology preference.

Policy played a catalytic role in converting this latent demand into actual sales. Import duty reductions, sales-tax adjustments, and clearer regulatory signals in 2023 lowered entry barriers for assemblers and importers. Equally important, these measures reduced uncertainty. Consumers are far more willing to experiment with new technology when they believe policy will not suddenly reverse or penalize adoption.

Still, the transition is uneven. Electric two-wheelers remain concentrated in urban and peri-urban areas where charging—often informal home charging—is feasible. Rural uptake is slower, reflecting both infrastructure constraints and the heavier duty cycles required in agricultural and inter-city travel. Battery quality, replacement costs, and resale value also remain critical concerns for buyers accustomed to the repairability and durability of conventional motorcycles.

The 4.6% market share reached by electric two-wheelers by 2025 should therefore not be interpreted as a ceiling, but as an early inflection point. If fuel prices remain high, electricity tariffs stay relatively predictable, and local assembly continues to improve quality and after-sales support, adoption could accelerate quickly. Pakistan’s two-wheeler market is large enough that even a shift to 15–20% electrification over the next decade would have meaningful implications for fuel imports, household transport costs, and urban air quality.

The larger lesson is that Pakistan’s energy transition is happening where it hurts the most economically. Just as solar adoption surged among households facing unreliable or unaffordable grid power, electric motorcycles are gaining ground where fuel costs have become unsustainable. This is not a top-down green transition; it is a bottom-up adaptation driven by household survival and cost minimization.

Whether this momentum is sustained will depend less on slogans and more on fundamentals: battery reliability, financing options, charging access, and policy consistency. If those align, electric two-wheelers could quietly reshape Pakistan’s transport landscape—one commuter at a time.